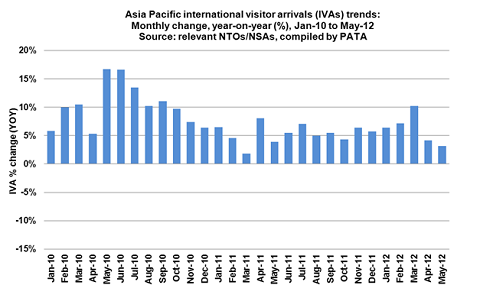

International Visitor Arrivals into Asia Pacific1 destinations during May 2012 showed a collective gain of 3% year-on-year according to preliminary results released today by the Pacific Asia Travel Association (PATA). This was the second consecutive month with a declining growth rate and heralds the impact of the various economic contagions across the globe. For the first five months of 2012, the average growth in international visitor arrivals into Asia Pacific destinations was 6% up year-on-year.

North America is showing a similar but more volatile growth pattern. After registering a solid 12% increase in foreign arrivals during March, the growth trend reduced to just 0.5% in April and then contracted by1% in May 2012. Canada and the USA managed to sustain positive growth of 2% and 1% respectively during the month but a contraction in international arrivals into Mexico for both April and May (-6% each month) has affected the overall sub-regional performance. A slowing of intra-regional travel demand was the major negative factor along with a 4% drop in UK arrivals.

Growth to Northeast Asia was also somewhat slower with a 4% increase, year-on-year. A general softening of foreign travel flows and falling demand between China and its two SARs continued to constrain overall growth in arrivals to China (-2%) and Macau SAR (-7%) during the month of May. Arrivals to Chinese Taipei (+27%), Hong Kong SAR (+13%) and Korea (ROK) (+27%) were however robust and well supported by a rebound in arrivals from Japan and the resilient Chinese market. Japan had an exceptional result (+87%) but has yet to reach the pre-crisis level of international arrivals, although that is likely to happen within the next few months.

Foreign arrivals to South Asia grew by a moderate 6% during the month. Despite a weak result from the Maldives (-1%) and a relatively slower month for Nepal (+9%), the overall trend for the sub-region still showed some promise compared to the previous month. India was up 5% during May 2012 while Sri Lanka managed a double-digit growth in arrivals (+18%). This upward trend seems to be continuing as early results for June suggest another lift in the arrivals growth rate.

Even under these trying conditions, Southeast Asia still managed solid growth of 8% during the month to become the fastest growing destination in Asia Pacific. Even so the growth trend is still downward, falling from a high of 15% in March to 9% in April and 8% in May. There are positives however. The Philippines showed a slower but still significant increase of 6% after four consecutive months of double-digit growth. Similarly Cambodia (+23%), Indonesia (+8%), Singapore (+14%) and Thailand (+8%) performed well above the sub-region?s average, while Myanmar in particular was very strong performer recording a 53% gain in foreign arrivals during May 2012. Vietnam however posted negative growth (-13%) for the month, the first time this has happened since September 2011.

The relatively strong performance of the Pacific in recent months, continued through May. After closing a year of stagnant growth in 2011, the upward trend kicked off in January and maintained momentum since March. Although travel demand remains volatile, the short-term outlook seems very promising. During May 2012, foreign arrivals to the Pacific grew 8% year-on-year, driven largely by the robust growth in foreign arrivals to Guam (+17%) and Hawaii (+12%). Most of the smaller island destinations in the Pacific also reported positive growth led by Samoa (+30%), the Northern Marianas (+20%) and Tahiti (+8%). The larger dominant destinations of Australia (+2%) and New Zealand (+0%), recorded another month of relatively slower growth or stagnation.

Commenting on the latest PATA tourism statistics, Martin J Craigs, PATA CEO, said: ?While there is significant variation in the results at the sub-regional and destination levels, the majority of Asia Pacific economies still reported growth during the month of May 2012. It is evident, however, that the toughening global marketplace is having an impact on the Asia Pacific region. None of us can be afford to be complacent as we reach the midway point of calendar year 2012.?

1Asia Pacific is defined as including the following sub-regions for the purposes of press releases:

North America= Canada, Mexico and the US

Northeast Asia = China, Chinese Taipei, Hong Kong SAR, Japan, Korea (ROK), Macau SAR and Mongolia

Southeast Asia = Cambodia, Indonesia, Lao PDR, Myanmar, Philippines, Singapore, Thailand and Vietnam

South Asia = Bhutan, India, Maldives, Nepal, Pakistan and Sri Lanka

The Pacific = Australia, Cook Islands, Fiji, Guam, Hawaii, Kiribati, Marshall Islands, New Caledonia, New Zealand, Niue,

Northern Marianas, Palau, Papua New Guinea, Samoa, Tahiti, Tonga, Tuvalu and Vanuatu

Results are preliminary; estimates are used for missing data. All comparative figures are year-on-year unless otherwise stated.

For more market trends and insights, please visit http://mpower.pata.org/

Source: PATA?