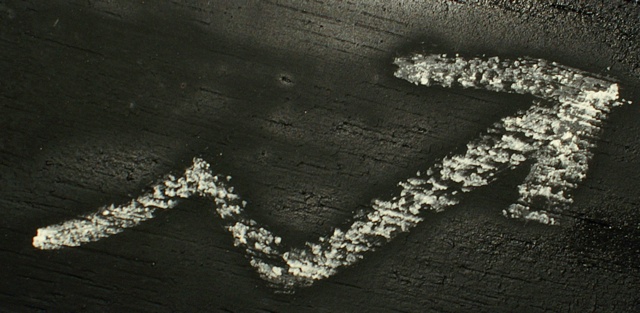

Global business and leisure hotel bookings remained steady in October according to ?Pegasus Solutions, the world?s largest processor of electronic hotel transactions. As bookings continued a steady year-to-date climb for both channels, rates paid improved slightly over prior year.

Global business and leisure hotel bookings remained steady in October according to ?Pegasus Solutions, the world?s largest processor of electronic hotel transactions. As bookings continued a steady year-to-date climb for both channels, rates paid improved slightly over prior year.

The number of global corporate bookings, those made through the global distribution systems (GDS), in October 2013 matched that of October 2012. Rates increased a slight +0.5% over prior year, despite global political issues and the US government shutdown. Year-to-date, rates inched up +0.6% over 2012, which is not to be overlooked, according to David Millili, chief executive officer of Pegasus Solutions.

?Five years ago, our industry had just been hit with the effects of the economic downturn,? said Millili. ?Hotels across every region and segment experienced a dip in occupancy and rates. Bookings have been recovered for a couple of years now, but we continue to struggle to return rates to 2007 levels. For the corporate channel, October rates actually set a year-to-date pace of +1.1% over October 2007, though they were still off that month?s performance by -3.5%. Every bit of growth we see in those rates brings us closer to being fully ?recovered?, which is still a ways off for the leisure market.?

Leisure bookings came within -1.3% of last year, setting a pace of +1.7% year-to-date. Rates travelers paid were +2.3% higher than 2012, upholding the +2.7% year-to-date growth pace over prior year. This slight improvement during an off-peak season indicates promising growth for 2013?s upcoming holiday travel. Compared to October 2007 levels, leisure rates are still off by -15.7%, even as volumes are a full +25.1% higher.

More stable booking volume is expected through the end of the year for both corporate and leisure bookings. Rates for the corporate market will continue to grow through December, with an extra bump expected in January. Consumers booking through online channels will be paying about +3% higher rates than prior year through the first of 2014.

Data reported by ?Pegasus Solutions?comes from billions of transactions processed monthly for nearly 100,000 hotel clients, facilitating more than $16 billion a year. ?The Pegasus View, produced quarterly, is the only industry report to reflect data drawn from both GDS and ADS transactions, representing the business and leisure markets respectively. Pegasus? PegasusView Market Performance business intelligence is a monthly reporting product augmenting the global data provided quarterly in?The Pegasus View.